Welcome to our May 24 Property Market Snapshot.

May at a glance

- Home Values saw a 0.8% increase, the 16th consecutive month of growth and the largest monthly gain since October last year

- Perth, Adelaide, and Brisbane continue to lead this increase.

Dwelling values

Source: CoreLogic Hedonic Home Value Index, 3 June 2024.

Rental market

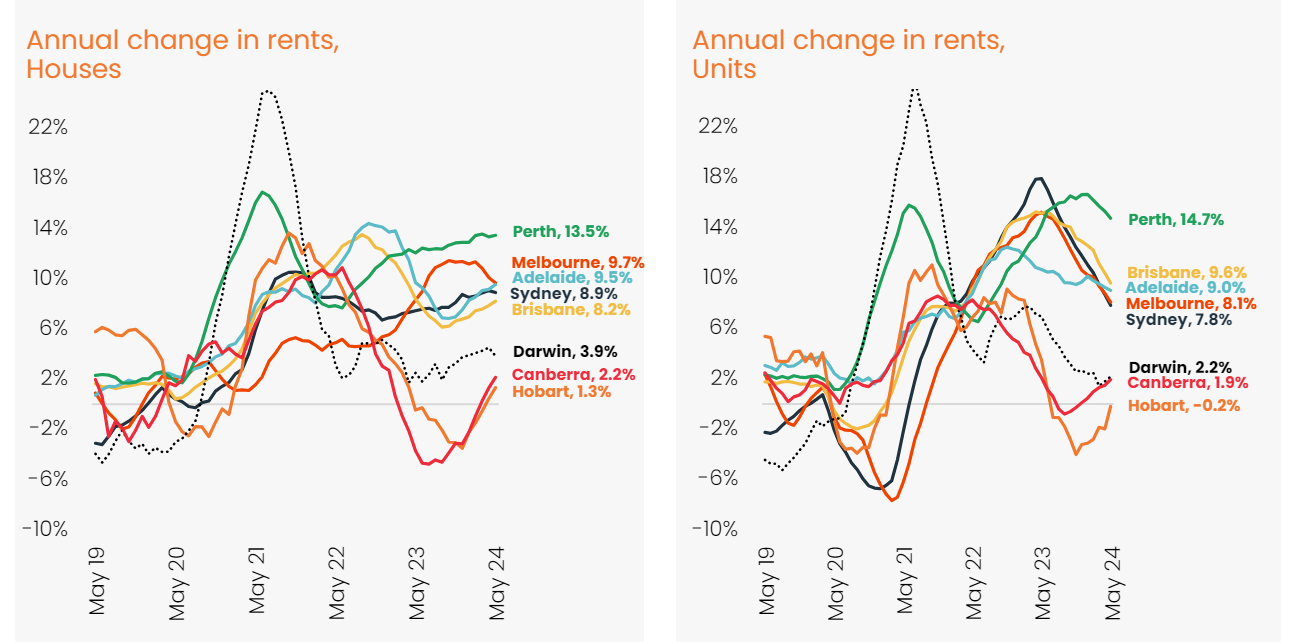

In recent months, there has been a notable deceleration in the growth rate of Australia’s rental markets. The national rental index only increasing by 0.7% in May, the smallest monthly change since December last year. This slowdown is noticeable across most cities, particularly in the unit sector. This indicates a broader easing in rental demand compared to the typically high demand experienced in the first quarter of the year. Despite this moderation, rents rose by 8.5% nationally over the past 12 months. Though this is a slower pace than seen in previous years.

Several factors contribute to this trend, including a gradual decrease in net migration since early 2023 and ongoing affordability challenges in the rental market. Furthermore, the completion of dwellings linked to the HomeBuilder scheme is anticipated to prompt homeowners to transition from rental properties to their newly constructed homes. Despite the slowdown in rental growth, gross rental yields have increased to 3.56% across combined capitals, the highest level since August 2019. This uptick in yields is advantageous for investors, particularly given the persistently high variable interest rates for investor loans.

Source: CoreLogic Hedonic Home Value Index, 3 June 2024.

Outlook

CLICK HERE TO DOWNLOAD THE FULL REPORT

Source: CoreLogic Hedonic Home Value Index, 3 June 2024.

Disclaimer: The opinions posted within this blog are those of the writer and do not necessarily reflect the views of Better Homes and Gardens® Real Estate, others employed by Better Homes and Gardens® Real Estate or the organisations with which the network is affiliated. The author takes full responsibility for his opinions and does not hold Better Homes and Gardens® Real Estate or any third party responsible for anything in the posted content. The author freely admits that his views may not be the same as those of his colleagues, or third parties associated with the Better Homes and Gardens® Real Estate network.