December at a glance

- National dwelling values dropped by 1.1% in December,

- The largest monthly declines were in Hobart (-1.9%) and Brisbane (-1.5%),

- Perth was the only city to record a marginal increase in values,

- Over the full year 2022, house priced reduced by 5.3% nationally,

- There were 12,284 new properties advertised for sale in the 4 weeks to 25 December 2022 which is 30.6% below this time last year,

- National rent prices increased by 0.6% over the past month taking the total growth to 10.2% for the year.

House prices

The value of Australian property reduced by 1.1% over the month of December, taking the annual change to -5.3%. Most cities recorded declines between 1.2% and 1.9% as we begin to see some commonality across the country. Perth remains the outliner with no change in values over the past quarter.

Source: CoreLogic Hedonic Home Value Index, 3 January 2023.

Source: CoreLogic Hedonic Home Value Index, 3 January 2023.

The gap between the change in prices between capital cities and regional areas has also diminished with the decline over the last month and quarter now very aligned.

The ongoing normalisation of house prices means first home buyers will find it a little more affordable. The median value of property in Sydney will likely drop below one million next month where is has not been for some time. The current median value is $1,009,428 in Sydney, $752,777 in Melbourne, $707,658 in Brisbane, $649,041 in Adelaide, and $560,902 in Perth.

Still on a good thing

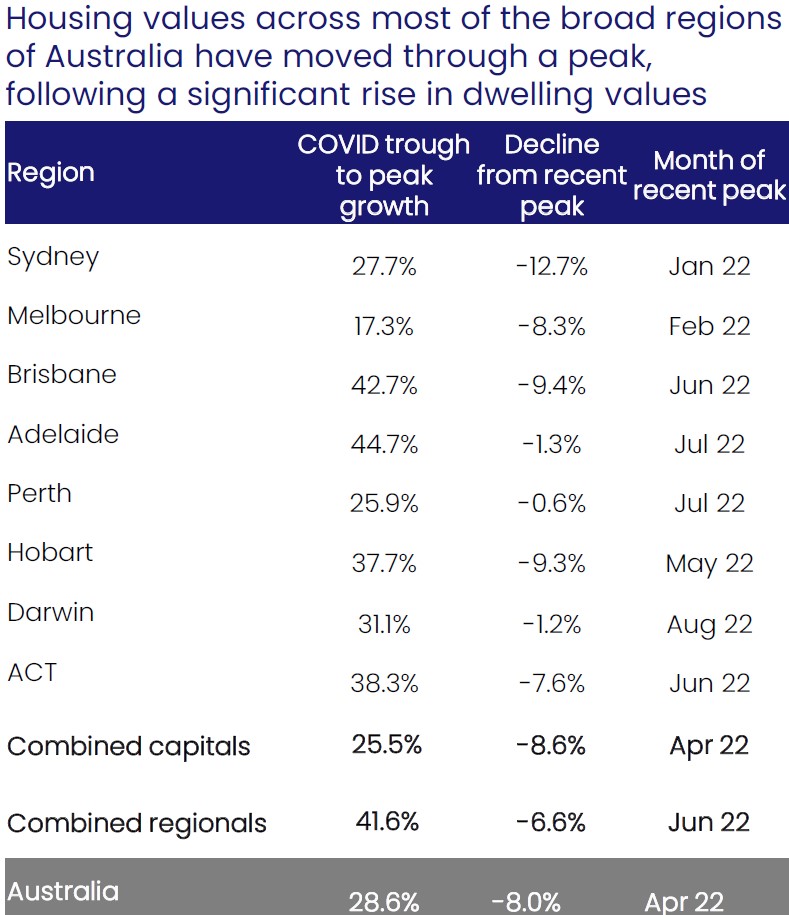

The full 2022 year was notably the largest calendar year decline in value since the Global Financial Crisis in 2008 when values dropped by 6.4%. While we are seeing prices drop on a monthly basis, it is important to reflect on the gains for home owners over a longer term.

The table below shows the increase in house prices from the onset of COVID to when values peaked, then compares this to the decline since that peak. At a national level, dwelling values rose by 28.6% to its peak, only to drop by 8% leaving owners with a significant capital gain. Property prices have risen and fallen in cycles for decades so it is normal to see periods where prices do moderate and reduce.

Source: CoreLogic Hedonic Home Value Index, 3 January 2023.

Inventory remains low

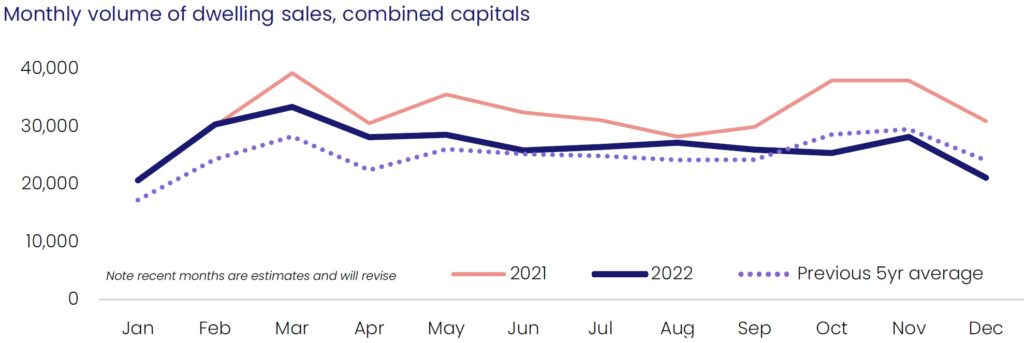

There were 12,284 new properties advertised for sale in the 4 weeks ending 25 December 2022. This is 30.6% lower than this time last year. There are currently 78,696 active property listings which is slightly lower than it was 12 months ago. The lower inventory means buyers do not have as much stock to select from and has assisted in house prices not falling more than they have.

Source: CoreLogic Hedonic Home Value Index, 3 January 2023.

Rental market

Rental demand continues to remain high with the yearly national vacancy rate ending at 1.2%, underpinned by a strong return in overseas migration and a limited supply of rental properties.

The 0.6% increase in rental prices over December took the yearly growth to 10.2%. Strong numbers were recorded in Sydney and Brisbane unit rents which increased 15.5% and 15.0% respectively, and house rents in Brisbane and Adelaide which grew 13.0% and 12.8%.

CoreLogic’s Research Director, Tim Lawless noted “As renters face worsening affordability pressures, it’s logical to expect more rental demand to transition towards higher density options, where rents are

generally more affordable”.

Outlook

The market is expecting a further 0.25% increase in the official cash rate by the Reserve Bank early in 2023 however whether there is more remains uncertain. House prices will likely continue to see marginal declines in the first quarter, while no relief in sight for a return to stronger inventory levels.

One aspect to look out for is the transition to a higher mortgage rate for borrowers who will see their fixed loan terms end during 2023. The RBA noted in its recent Financial Stability Review that over 20% of outstanding housing credit is on fixed terms which are set to expire this year.

CLICK HERE TO DOWNLOAD THE FULL REPORT

Author: Frank Knez

Disclaimer: The opinions posted within this blog are those of the writer and do not necessarily reflect the views of Better Homes and Gardens® Real Estate, others employed by Better Homes and Gardens® Real Estate or the organisations with which the network is affiliated. The author takes full responsibility for his opinions and does not hold Better Homes and Gardens® Real Estate or any third party responsible for anything in the posted content. The author freely admits that his views may not be the same as those of his colleagues, or third parties associated with the Better Homes and Gardens® Real Estate network.