Welcome to our April 24 Property Market Snapshot.

April at a glance

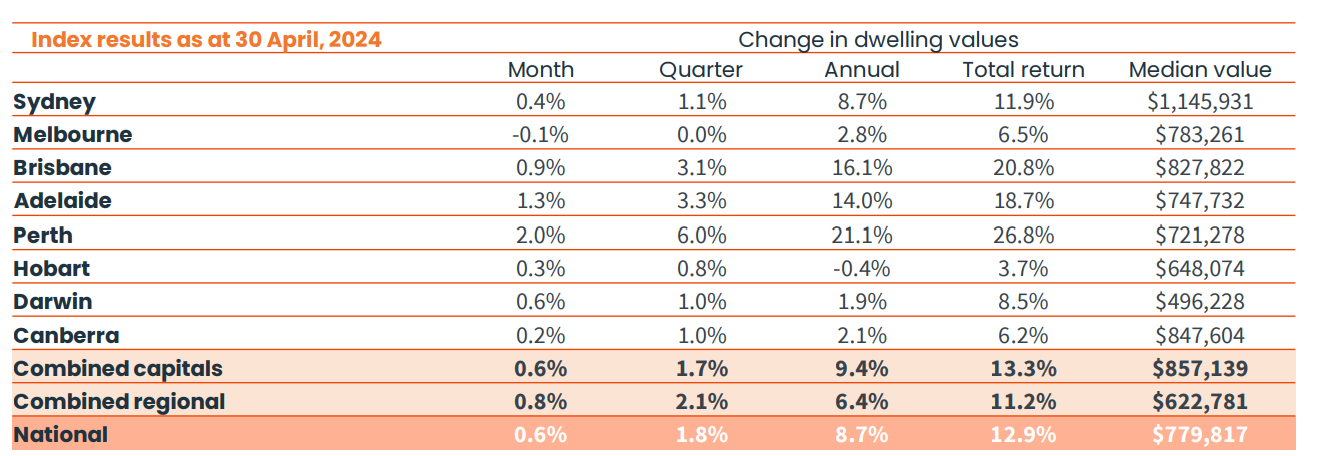

- In April, Home Values saw a 0.6% increase, continuing an upward trend despite concerns about high interest rates and inflation.

- Perth, Adelaide, and Brisbane are leading this increase, while Sydney and Melbourne have stabilised.

- Most capital cities witnessed quarterly rises in dwelling rents surpassing 2.0%, with Perth leading at a 3.9% increase.

Dwelling values

In April, Australian housing values continued their upward trajectory, rising by 0.6%, despite concerns about high interest rates and inflation. This marks the 15th consecutive month of growth, with values climbing by 11.1% since January of the previous year.

Mid-sized cities like Perth, Adelaide, and Brisbane are leading this surge, while Sydney and Melbourne have stabilised. Smaller cities such as Hobart and the Australian Capital Territory (ACT) are also experiencing modest increases. Perth’s market remains robust, while Brisbane’s growth has slowed slightly due to affordability challenges.

Lower-value properties and unit values are outpacing higher-value properties and houses in most cities. Regional markets have shown stronger growth rates compared to capital cities recently. Although home sales peaked in November, they have since remained steady due to affordability concerns and subdued sentiment, with expectations for increased activity once interest rates decline.

Source: CoreLogic Hedonic Home Value Index, 1 May 2024.

Rental market

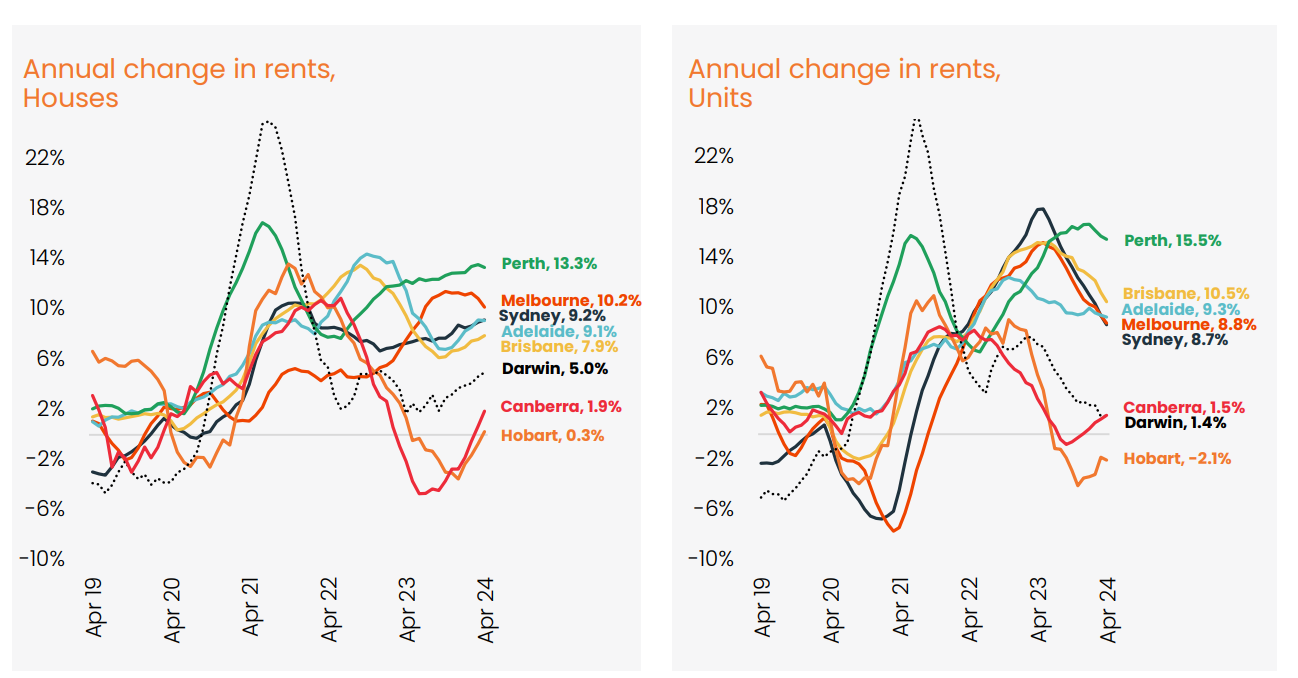

During the month, national rents saw a 0.8% increase, slightly slower compared to the growth rates of February and March. This deceleration in rental growth may be attributed partly to seasonal factors, like heightened student demand and new leases at the start of the year. Moreover, as net overseas migration peaks, rental demand could gradually ease, though the supply remains constrained.

Most capital cities witnessed quarterly rises in dwelling rents surpassing 2.0%, with Perth leading at a 3.9% increase. Yet, Darwin was the lone capital to experience a decline in rents, albeit minimally at -0.1%. Despite the rise in rental yields since November, reaching 3.75% nationally, investors with substantial leverage might still encounter negative cash flow due to average mortgage rates hovering around 6.7%.

Source: CoreLogic Hedonic Home Value Index, 1 May 2024.

Outlook

CLICK HERE TO DOWNLOAD THE FULL REPORT

Source: CoreLogic Hedonic Home Value Index, 1 May 2024.

Disclaimer: The opinions posted within this blog are those of the writer and do not necessarily reflect the views of Better Homes and Gardens® Real Estate, others employed by Better Homes and Gardens® Real Estate or the organisations with which the network is affiliated. The author takes full responsibility for his opinions and does not hold Better Homes and Gardens® Real Estate or any third party responsible for anything in the posted content. The author freely admits that his views may not be the same as those of his colleagues, or third parties associated with the Better Homes and Gardens® Real Estate network.