March at a glance

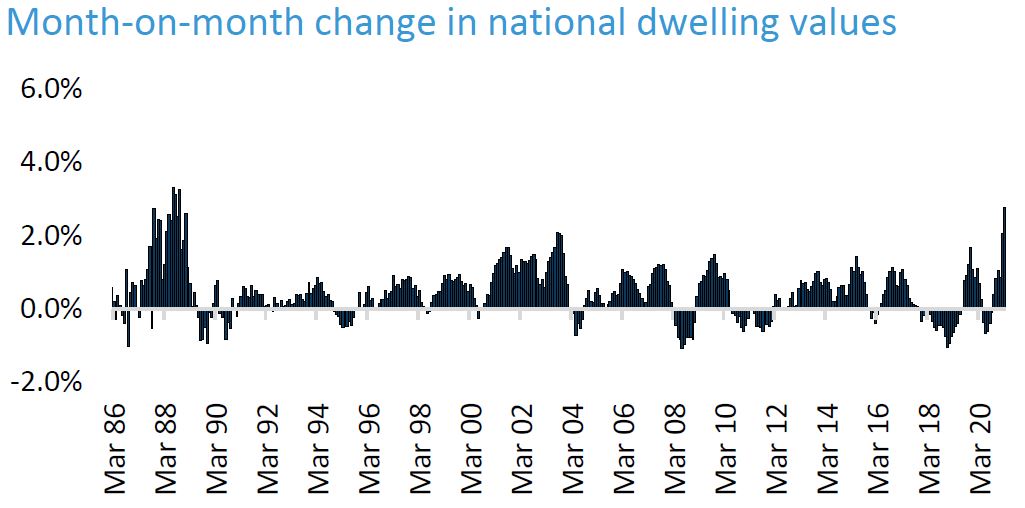

- Dwelling values continued to rise in March with the national average up by 2.8%,

- We need to go back to October 1988 to see the last time growth exceeded this rate where it reached 3.2%,

- For the first time in 12 months, capital city values were higher than regional markets,

- The low number of properties advertised for sales continues, although we are seeing an increase,

- Rental values are rising at a record rate in Perth and Darwin.

Housing values

With home values increasing at the fastest pace in 32 years, the market has well and truly recovered from the impact of COVID.

Sydney prices rose the highest with a 3.7% growth in March, followed by Hobart at 3.3%; the only two states above the 2.8% national average. The median dwelling value in the combine capital cities is now $693,936, while in regional markets it has grown to $448,819. March saw capital city values outpace those in regional areas, with a 2.8% lift compared to 2.5%.

Source: CoreLogic Hedonic Home Value Index, 1 April 2021.

The surge in values continue to be underpinned by interest rates and advertised properties both remaining very low, improving consumer sentiment, and fear of missing out.

The sharp rise in values in recent months is highlighted in the far right on the chart below which depicts the monthly change in values. The increase has been sharp and significant, and far exceeds the drop during the COVID months prior.

Source: CoreLogic Hedonic Home Value Index, 1 April 2021.

Excess demand

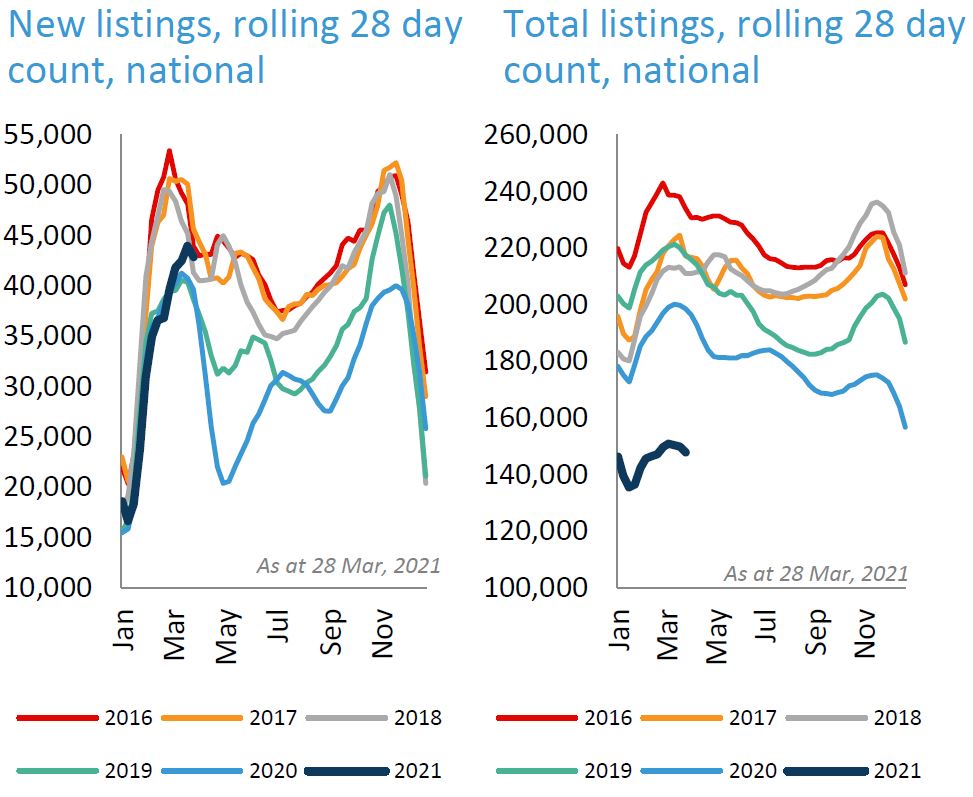

The number of total properties on the market remains at a historic low, with advertised stock 25.5% below the five year average. The main reason total listing are so low is due to buyer demand consistently being greater than supply.

Research Director at CoreLogic, Tim Lawless states that “such a rapid rate of absorption is keeping overall inventory levels low and adding to a sense of FOMO amongst buyers”.

Source: CoreLogic Hedonic Home Value Index, 1 April 2021.

On the positive side, new properties being advertised for sale has started to increase to above average levels. In the past month, new listings nationally are 8.1% higher than a year ago. Should this trend continue, it may soon alleviate the upward pressure on housing prices as supply begins to meet the pent up demand for property.

Michelle Delaney, CEO of Better Homes and Gardens Real Estate, said “What we have now is a sellers market, where the number of eager buyers exceeds the properties available to purchase. This means it is a great time to sell for anybody who has been considering the sale of their investment property”.

Summary

With the number of home sales over the previous three months 21.9% higher than a year ago, we are likely to see a continuation of the strong demand for property over the next quarter. This will be more prominent in the premium end of the housing market where the capital gains have been highest.

It is reasonable to expect that there will be a slow down in the pace of growth throughout 2021 as supply catches up to demand. The uncertainty lies in what will trigger the next downswing in the property cycle.

CLICK HERE TO DOWNLOAD THE FULL REPORT

Author: Frank Knez

Disclaimer: The opinions posted within this blog are those of the writer and do not necessarily reflect the views of Better Homes and Gardens® Real Estate, others employed by Better Homes and Gardens® Real Estate or the organisations with which the network is affiliated. The author takes full responsibility for his opinions and does not hold Better Homes and Gardens® Real Estate or any third party responsible for anything in the posted content. The author freely admits that his views may not be the same as those of his colleagues, or third parties associated with the Better Homes and Gardens® Real Estate network.