March at a glance

- Dwelling values rose by 0.7% in the month of March, similar to the growth last month,

- Sydney prices declined for the second month in a row, this time by 0.2%,

- Brisbane and Adelaide continued to perform best, as did the regional markets,

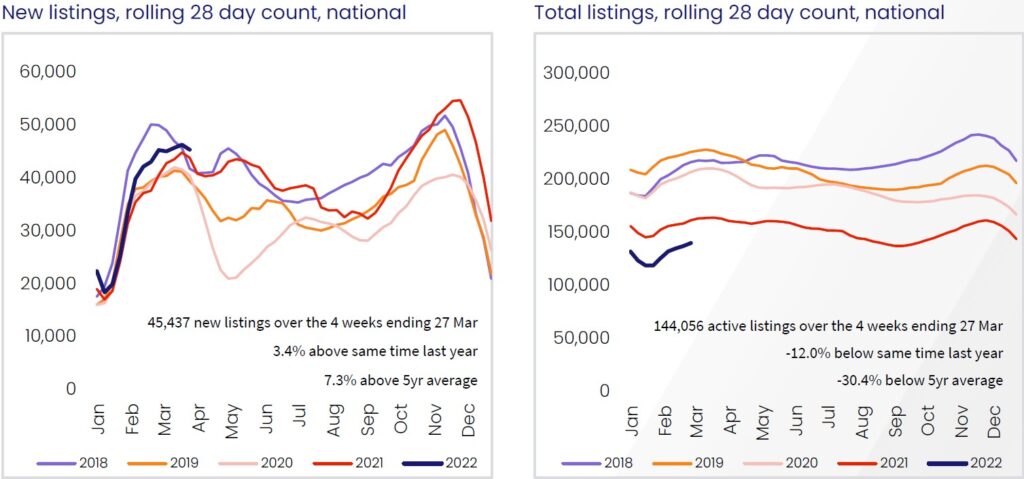

- New properties advertised for sale continue to increase however total properties on the market remains historically low,

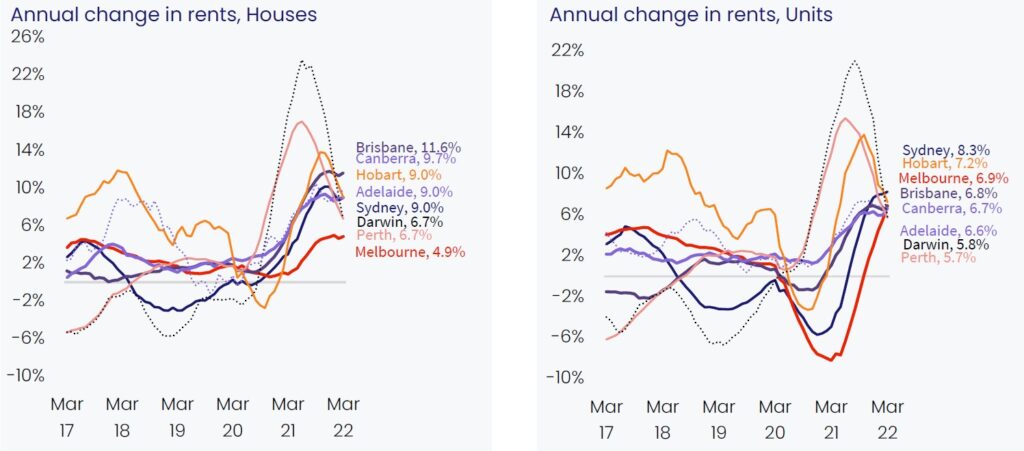

- Growth in rental prices on units increased by 3% over the last month.

Housing values

At a national level, house prices increased by a modest 0.7% underpinned by Brisbane (2.0%), Adelaide (1.9%), Canberra (1.0%) and Perth (1.0%). Sydney and Melbourne both moved into negative territory with prices declining by 0.2% and 0.1% respectively.

Regional areas continue to outperform most capital cities, with prices rising by 1.7% over March, and 24.5% over the last year. The median house price in the combined regional areas is $577,987 which is significantly more affordable that those in Sydney ($1,116,889), Canberra ($932,704), Melbourne ($805,232) and Brisbane ($749,293).

Source: CoreLogic Hedonic Home Value Index, 1 April 2022.

Source: CoreLogic Hedonic Home Value Index, 1 April 2022.

Inventory slowly picking up

There were over 45,000 new property listings during the month of March which is an increase from the seasonal lulls between December and February. Despite this, total properties on the market for sale remains historically low; 12% below this time last year and 30.4% below the 5 year average.

At a state level, Brisbane has seen the lowest level of inventory, with total houses on the market 24.5% lower than a year ago, followed by Adelaide at -19.8%, while Darwin has 18.1% more total properties for sale, Sydney and Melbourne who recorded increases of 7.5% and 5.5% respectively.

Source: CoreLogic Hedonic Home Value Index, 1 April 2022.

It has been this elongated low level of properties available to purchasers that has contributed to the rapid rise in house values over the previous 18 months as prospective buyers have competed for scare properties. As the number of properties available to buy starts to normalise, we should see a lengthening of the time a listed property is on the market, and less heat in the market.

Rental market

Trends in the rental market have become diverse across the country. Overall rents continue to increase with the annual rental growth sitting at 8.7% over the past 12 months. Brisbane has led the charge in relation to rents in houses, rising by 11.6% over the year, followed by Canberra at 9.7%, and Adelaide, Hobart and Sydney all at 9.0%.

Source: CoreLogic Hedonic Home Value Index, 1 April 2022.

By comparison rents in units increased in the last year by 8.3% in Sydney, 7.2% in Hobart, and between 6.6% and 6.9% in Adelaide, Canberra, Brisbane and Melbourne.

Tim Lawless, research director at CoreLogic said “Through the pandemic to date, capital city house rents have risen by 13.8% compared with a 3.4% rise in unit values”.

Outlook

Our two largest cities, Sydney and Melbourne, are seeing flat to marginally reducing dwelling values compared to Adelaide and Brisbane where prices are still rising.

National housing values are expected to soften over 2022 on the back of rising fixed interest rates and the expectation of variable mortgage rates to follow soon. Affordability has also become more of a factor as the 18.2% increase in national property values of the last 12 months has made property ownership out of reach for many more people.

New government incentives for first home buyers and a return to normal migration levels may on the other hand contribute to maintaining a level of buyer demand and mitigate house prices from losing much of the strong gains in recent years.

CLICK HERE TO DOWNLOAD THE FULL REPORT

Author: Frank Knez

Disclaimer: The opinions posted within this blog are those of the writer and do not necessarily reflect the views of Better Homes and Gardens® Real Estate, others employed by Better Homes and Gardens® Real Estate or the organisations with which the network is affiliated. The author takes full responsibility for his opinions and does not hold Better Homes and Gardens® Real Estate or any third party responsible for anything in the posted content. The author freely admits that his views may not be the same as those of his colleagues, or third parties associated with the Better Homes and Gardens® Real Estate network.