November at a glance

- National house prices reduced by 1.0% over the month of November,

- The largest drops were in Brisbane and Hobart where values declined by 2.0%,

- Perth and Darwin were the only cities not to recorded a reduction in values,

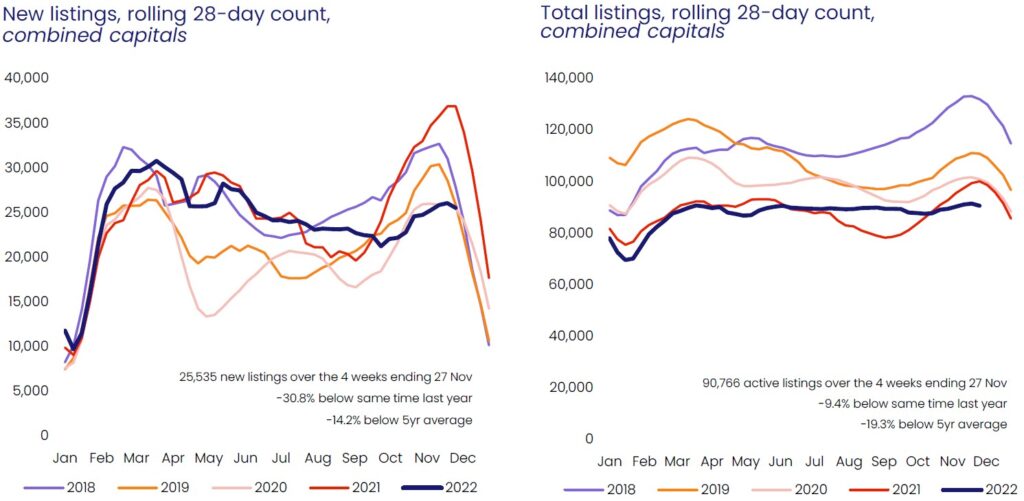

- There were 25,565 new properties advertised for sale in the 4 weeks to 27 November which is 31% below this time last year,

- Gross rental yields across the combined capitals rose to 3.5% in the month of November.

House prices

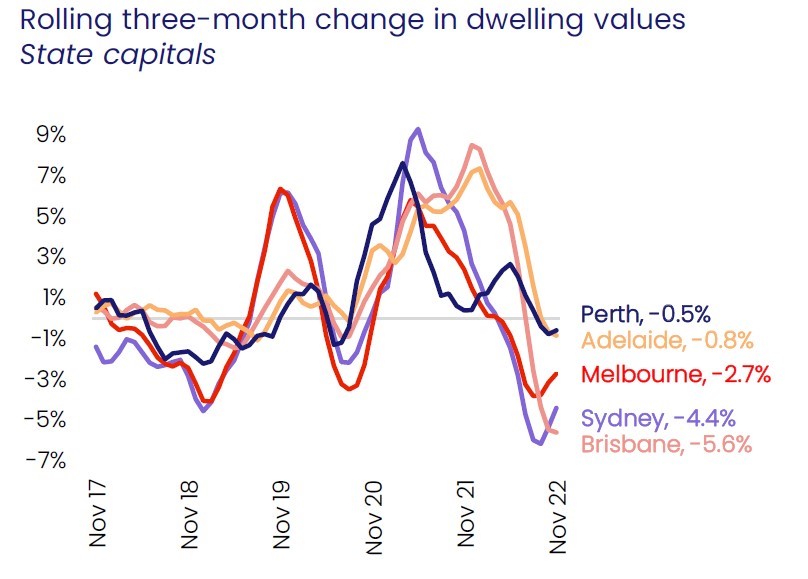

The value of property in Australia at a national level reduced by 1% over the month, marking the seventh consecutive decline. We continue to see varying markets across the country with some states down by 2% while others remaining flat or increasing in value as is the case in Hobart.

Source: CoreLogic Hedonic Home Value Index, 1 December 2022.

Source: CoreLogic Hedonic Home Value Index, 1 December 2022.

While property values are reducing, the rate of decline has slowed in recent months. This is due to an easing of the decline in Sydney and Melbourne where in August recorded price changes of -2.3% and -1.5% respectively compared to -1.3% and -0.8% over November.

The gap between the change in values in capital cities and regional areas has also continued to narrow with the quarterly change on par at -3.5%. As prices in capital cities started falling before these in regional areas, the 12 month performance is still more favourable in the latter with growth of +3.3% compared to -5.2% in the combined capitals.

The continued normalisation of dwelling values will mean buyers seeking to enter the property market will find it a little more affordable. Should the trend continue we may even see the median value of property in Sydney drop below the one million mark. The current media value is $1,025,684 in Sydney, $759,496 in Melbourne, $715,130 in Brisbane, and $654,979 in Adelaide.

Source: CoreLogic Hedonic Home Value Index, 1 December 2022.

Inventory remains low

There were 25,535 new properties advertised for sale in the 4 weeks ending 27 November. This is 30.8% lower than this time last year, which is a significant impact to stock levels and a contributor to property prices not falling further. There are currently 90,766 total properties advertised for sale which is also lower than it was 12 months ago and means buyers do not have as many options as they usually do during this popular spring selling season.

Source: CoreLogic Hedonic Home Value Index, 1 December 2022.

CoreLogic’s Research Director, Tim Lawless noted “Across the capitals, total listings haven’t been this low at this time of the year since 2010, and regional listings are at their lowest level since 2007. This is likely a key factor offsetting the negative impact of higher interest rates and low consumer sentiment.”

Rental market

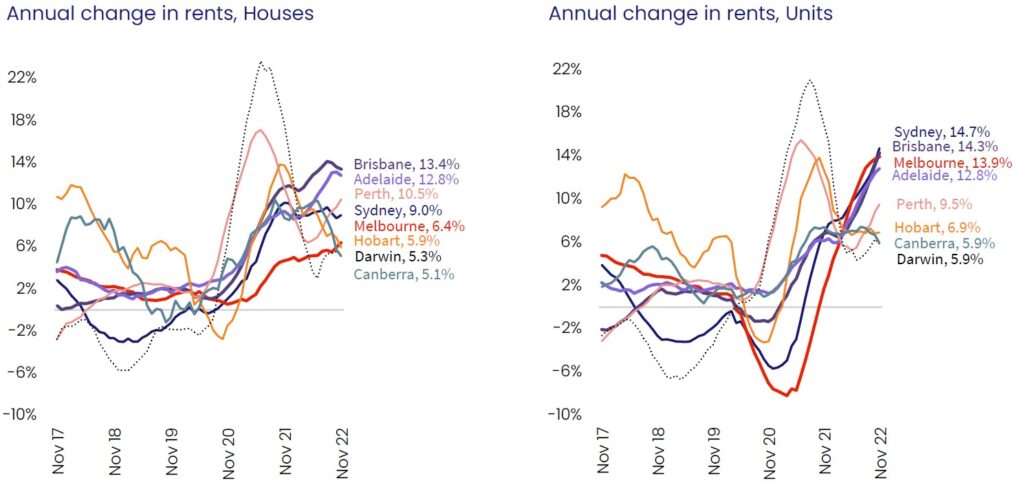

Rental demand continues to remain high over November with national vacancy rates sitting at around 1% or less. This is on the back of limited supply of rental properties and a rebound in net overseas migration.

The annual change in rents varies across the capital cities with sizable gaps between the best and worst performers. Brisbane recorded an annual increase in rent of 13.4% in houses and 14.3% in units compared to Canberra where houses rose 5.1% and units 5.9%.

Source: CoreLogic Hedonic Home Value Index, 1 December 2022.

Source: CoreLogic Hedonic Home Value Index, 1 December 2022.

Outlook

The further 0.25% increase in the official cash rate by the Reserve Bank on 6 December highlights the ongoing battle to contain inflation, and sees rates rising by 3.00% since 6 April 2022. The impact on mortgage rates and repayments seems to have been absorbed by borrowers to date with no material increase in 90-day arrears rates with lenders, and no surge in new listings from home owners needing to sell.

With inventory still relatively low, owners looking to sell are still able to achieve strong sale prices and capitalise on the rebound in auction clearance rates in the last few months of the year.

CLICK HERE TO DOWNLOAD THE FULL REPORT

Author: Frank Knez

Disclaimer: The opinions posted within this blog are those of the writer and do not necessarily reflect the views of Better Homes and Gardens® Real Estate, others employed by Better Homes and Gardens® Real Estate or the organisations with which the network is affiliated. The author takes full responsibility for his opinions and does not hold Better Homes and Gardens® Real Estate or any third party responsible for anything in the posted content. The author freely admits that his views may not be the same as those of his colleagues, or third parties associated with the Better Homes and Gardens® Real Estate network.