Welcome to our July 23 Property Market Snapshot.

July at a glance

- Housing values in Australia increased for a fifth consecutive month, with the national Home Value Index rising by 0.7%.

- Brisbane and Adelaide leading the pace of gains across the capitals with housing values up 1.4% across both cities.

- While housing values are broadly rising, the pace of growth slowed in the past two months, particularly in Sydney, where the monthly growth rate halved from 1.8% in May to 0.9% in July.

- The national rental index increased by 0.6% in July, marking the 35th consecutive month of growth, but the slowest rise since December 2021.

Dwelling values

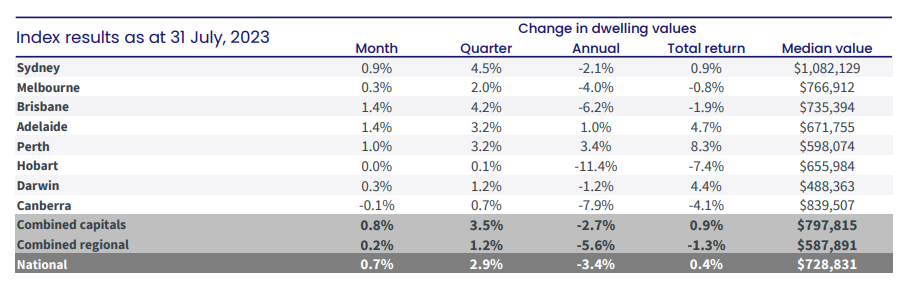

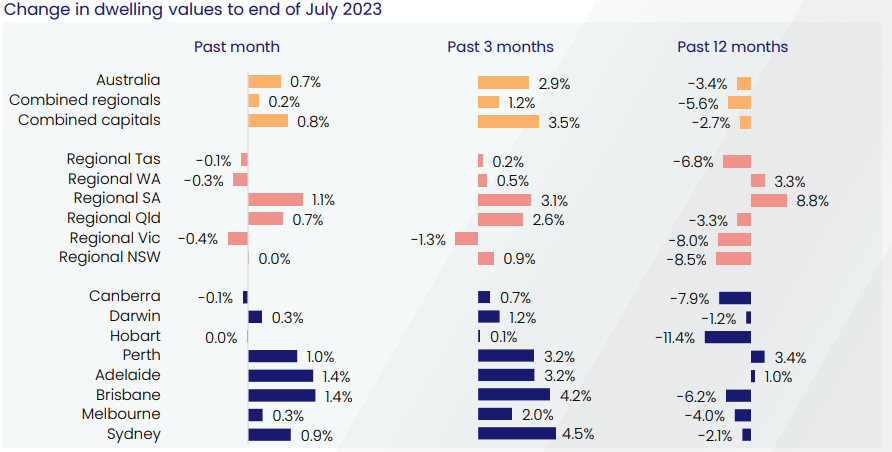

In July, Australia’s national Home Value Index saw a 0.7% rise, marking the fifth consecutive month of recovery in housing values. Since hitting a low point in February, the national HVI has surged by 4.1%, following a notable 9.1% decline from its peak in April 2022. However, housing values still stand 5.3% below the April 2022 peak, with only Perth, Adelaide, and Regional South Australia achieving new highs in dwelling values.

The overall growth in housing values has decelerated over the last two months, dropping from 1.2% in May. This reduction in growth has been particularly significant in Sydney, where the monthly growth rate has dwindled from 1.8% in May to 0.9% in July. The increased influx of new listings in the Sydney market might be contributing to this slower pace of growth by offering more choices for potential buyers and lessening the sense of urgency.

July saw an acceleration in growth for Brisbane and Adelaide, with housing values increasing by 1.4% in both cities. However, the number of new listings in these cities remains lower than levels from a year ago and the previous five-year average.

Source: CoreLogic Hedonic Home Value Index, 1 August 2023.

In regional areas, housing values continued to trail behind the major cities. Regional values increased by 0.2% in July, compared to a 0.8% increase in the combined capitals index. Different regional areas exhibited varying levels of growth, with the Gold Coast, South East region of Tasmania, and Newcastle/Lake Macquarie region experiencing the most significant increases over the past three months. Conversely, areas like Bendigo, Shepparton, and the Warrnambool/South West region of Regional Victoria recorded declines in housing values.

Source: CoreLogic Hedonic Home Value Index, 1 August 2023.

Rental market

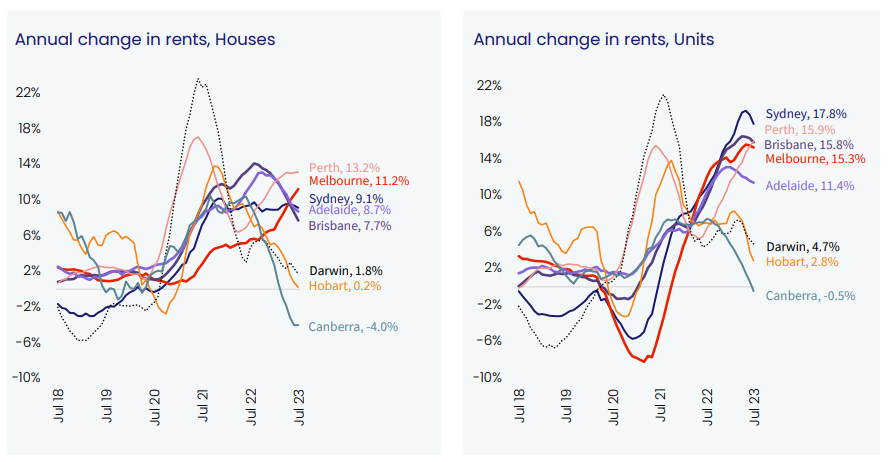

In July, the national rental index increased by 0.6%, marking the 35th consecutive month of growth, yet the slowest increase since December 2021. Notably, rental growth has eased in regional areas, with the combined regional rental index showing only a 0.2% rise in July, the smallest uptick since June 2020. Additionally, regional vacancy rates have risen from 1.3% in early 2022 to 1.6% in July.

The growth in rental rates within capital cities has also slowed, registering at 0.8% in July, the lowest monthly uptick since the previous December. During the past three months, Hobart and Canberra were the sole capitals to experience rental decreases.

The most robust rental growth persists within the unit sector, boasting a 2.9% increase in rents nationwide over the three months leading to July. This contrasts with a 1.9% rise in house rents. Particularly noteworthy unit rental growth was observed in Perth, Melbourne, and Brisbane, with Perth leading at 4.3%. In contrast, the Regional NT encountered a significant drop in house rents, declining by -6.4% over the past three months.

Source: CoreLogic Hedonic Home Value Index, 1 August 2023.

Outlook

The housing market remains resilient. The recent slowdown in growth follows a rapid initial recovery, potentially unsustainable due to rising interest rates, low consumer sentiment, and cautious lending conditions. The supply-demand balance is pivotal, with minimal advertised supply helping maintain housing prices and the market’s recovery. While an increase in new listings might balance supply, it depends on whether housing demand keeps pace.

Buyer activity has picked up despite high interest rates and hesitant sentiment, as seen in higher home loan commitments and lending values. A close link between sentiment and housing activity suggests improved consumer confidence could further support housing market growth. Yet, substantial purchasing activity might not occur until interest rates begin to decrease, a scenario projected for 2024. Although the peak of the rate hike cycle is near, interest rates are expected to remain elevated for a while, and a significant surge in mortgage defaults seems unlikely due to favorable labor market projections. Strong population growth is anticipated to sustain housing demand, while limited supply response continues. Net overseas migration and low dwelling approvals are likely to support housing demand.

Disclaimer: The opinions posted within this blog are those of the writer and do not necessarily reflect the views of Better Homes and Gardens® Real Estate, others employed by Better Homes and Gardens® Real Estate or the organisations with which the network is affiliated. The author takes full responsibility for his opinions and does not hold Better Homes and Gardens® Real Estate or any third party responsible for anything in the posted content. The author freely admits that his views may not be the same as those of his colleagues, or third parties associated with the Better Homes and Gardens® Real Estate network.