Welcome to our January 24 Property Market Snapshot.

January at a glance

-

Australia’s housing market saw a 0.4% rise in January 2024, marking the 12th consecutive month of increasing values.

-

The gap between capital city house and unit values hit a record 45.2% in January, emphasizing higher growth in house values. Regionally, the market outpaced combined capitals, growing 1.2% over the rolling quarter, while growth slowed in major cities, especially Melbourne and Sydney.

-

The market remains active, with home sales slightly above average in the past three months, reaching around 115,241 dwellings. Factors like high migration and tight rental markets drove sustained demand.

Dwelling values

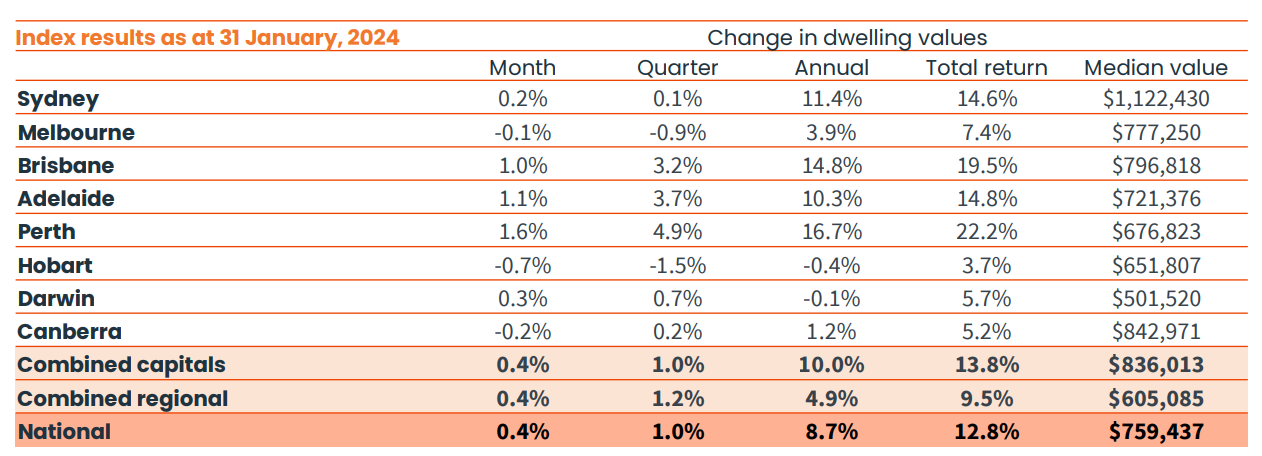

In January 2024, Australia’s housing market maintained its upward trajectory, reporting a 0.4% increase in CoreLogic’s national Home Value Index (HVI). This marked the 12th consecutive month of rising values. Regional disparities were evident, with Melbourne, Hobart, and Canberra experiencing subtle declines, while Perth, Adelaide, and Brisbane continued to see monthly increases of 1% or more. Perth stood out with a rapid rate of capital gains, witnessing a 1.6% increase in January and a substantial 16.7% surge over the past 12 months. Despite this, housing prices in Perth remain relatively affordable, with a median dwelling value just under $677,000.

The divergence between capital city house and unit values reached a record high of 45.2% in January, with house values outpacing unit values. The regional housing market outpaced the combined capitals, posting a 1.2% rise over the rolling quarter, while the combined capitals index increased by 1.0%. The slowdown in growth conditions was more pronounced in capital cities, particularly Melbourne and Sydney.

Concerns about housing affordability did not deter activity, as the volume of home sales remained slightly above average over the past three months. Approximately 115,241 dwellings were sold, reflecting an 11.9% increase compared to the same period the previous year. Contributing factors to this sustained demand included high migration and tight rental markets, potentially motivating renters to transition to homeownership despite challenges like high-interest rates and affordability constraints.

Source: CoreLogic Hedonic Home Value Index, 1 February 2024.

Source: CoreLogic Hedonic Home Value Index, 1 February 2024.

Rental market

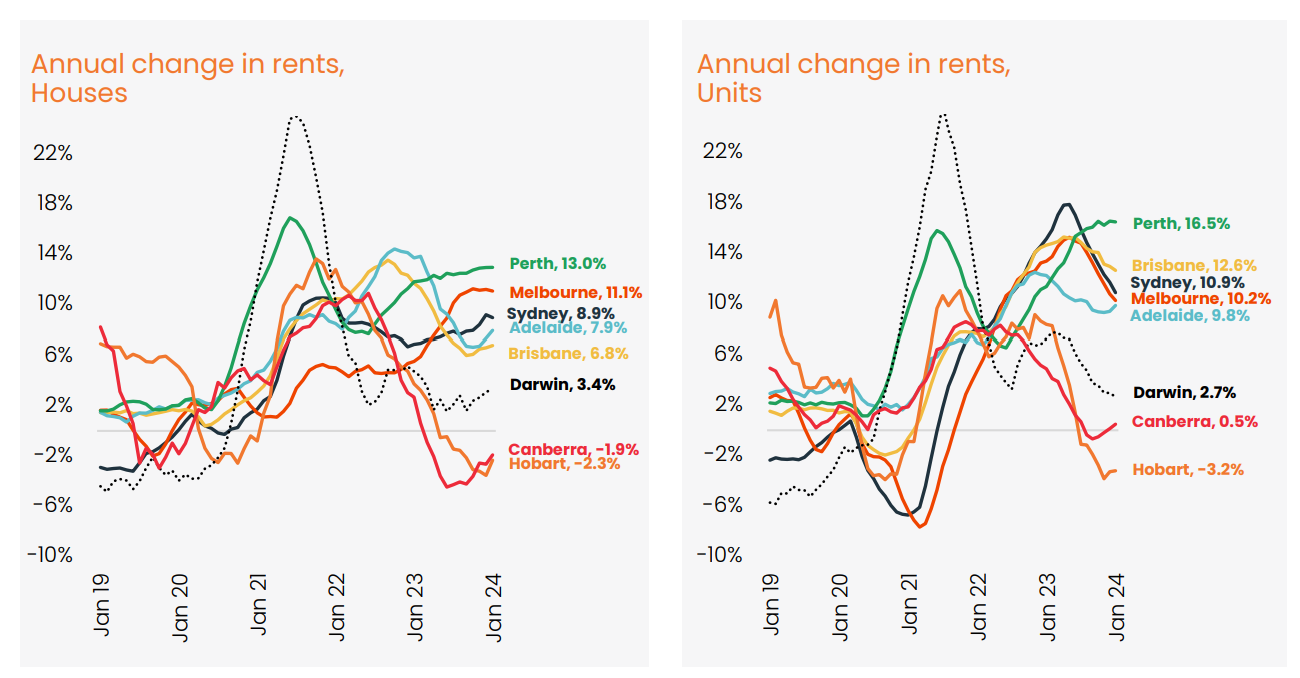

In January, the rental market witnessed an uptick in value growth as leasing activities entered the traditionally robust first quarter of the year. The national rental index posted its most robust monthly increase since April, with rents rising by 0.8% in January following a 0.6% uptick in December. As is customary, rental growth tends to accelerate through the March quarter, driven by heightened demand from students and the influx of new year leases, and this year seems poised to follow a similar trajectory.

Leading the rental growth trend over the rolling quarter were Perth and regional WA, with Perth unit rents surging by 3.7% in the three months ending January. Regional WA also saw a commendable 3.6% increase in house rents, while Perth houses experienced a growth of 3.5%. In contrast, Canberra and Hobart faced subdued rental conditions throughout the past year, and Darwin stood out as the sole capital city to register a decline in rents over the rolling quarter, with unit rents dropping by -1.6% and house rents by -0.4%.

A noteworthy shift in recent trends is the resurgence of house rents outpacing unit rents across most cities in the past three months. Across the combined capitals, house rents saw a robust 2.5% increase, surpassing the 1.4% lift in unit rents. This trend was observable in every capital except Perth. The deceleration in unit rental growth aligns with a probable peak in net overseas migration around the middle of the preceding year, particularly impacting Sydney and Melbourne. With expectations of a gradual easing in migration from the record highs, a further moderation in the upward pressure on unit rents is anticipated.

Source: CoreLogic Hedonic Home Value Index, 1 February 2024.

Outlook

The housing market in 2024 has kicked off much like 2023, witnessing an overall upward trend in values, though with variations across regions and housing types. Key factors shaping the year include inflation, interest rates, credit policy, consumer sentiment, and demographic trends. Inflation, peaking at 7.8% in 2022, has eased to 4.1% in December 2023, with expectations of further decline. Lower inflation is anticipated to relieve cost-of-living pressures and support consumer sentiment.

Consumer sentiment has remained persistently pessimistic since mid-2022, influenced by high living costs and interest rates. While the historical correlation between consumer confidence and home purchasing activity diverged in 2023, prospective easing of inflation and rate cuts later in the year may contribute to an improvement in sentiment.

Migration patterns are changing, marked by a peak in overseas migration last year and a reduction in extreme interstate movements. The decrease in overseas migration is expected to alleviate rental demand, particularly in major capitals. Anticipations suggest that recent peak levels of migration will impact purchasing activity in the housing market over the coming years.

Disclaimer: The opinions posted within this blog are those of the writer and do not necessarily reflect the views of Better Homes and Gardens® Real Estate, others employed by Better Homes and Gardens® Real Estate or the organisations with which the network is affiliated. The author takes full responsibility for his opinions and does not hold Better Homes and Gardens® Real Estate or any third party responsible for anything in the posted content. The author freely admits that his views may not be the same as those of his colleagues, or third parties associated with the Better Homes and Gardens® Real Estate network.