July at a glance

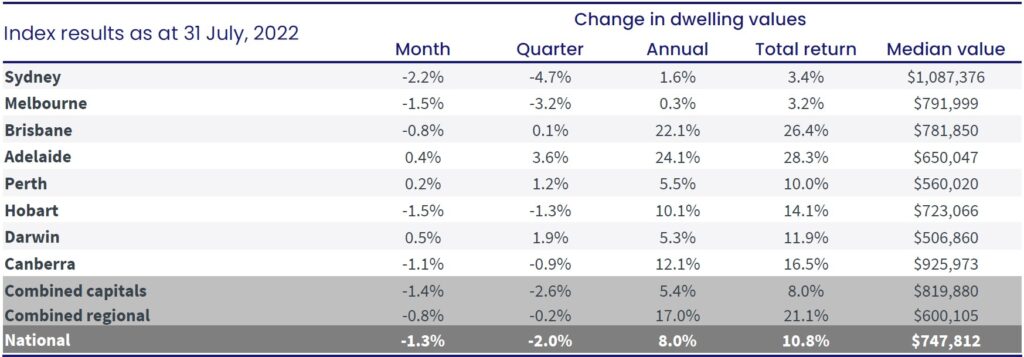

- House prices reduce by a further 1.3% nationally from the previous month,

- The largest drops were seen in Sydney (-2.2%), Melbourne (-1.5%) and Hobart (-1.5%),

- Darwin, Adelaide and Perth were the only cities to record growth in their housing values,

- 36,615 new properties were advertised for sale in the 4 weeks ending 24 July,

- National rents increased by 0.9% over July taking it to an annual growth of 9.8%.

Dwelling values

July saw the third consecutive month where national house priced reduced. The drop over the last month is 1.3% at a national level, spearheaded by Sydney where values reduced by 2.2%, and Melbourne 1.5%. The reduction was visible in both the combined capitals and regional areas, although the latter continues to perform better.

Source: CoreLogic Hedonic Home Value Index, 1 August 2022.

Source: CoreLogic Hedonic Home Value Index, 1 August 2022.

The driver for this change is the 1.75% increases in the cash rate target by the Reserve Bank over the last 4 months which has dampened buyer activity. A good supply of inventory has also meant buyers have greater choice and do not need to rush into purchases.

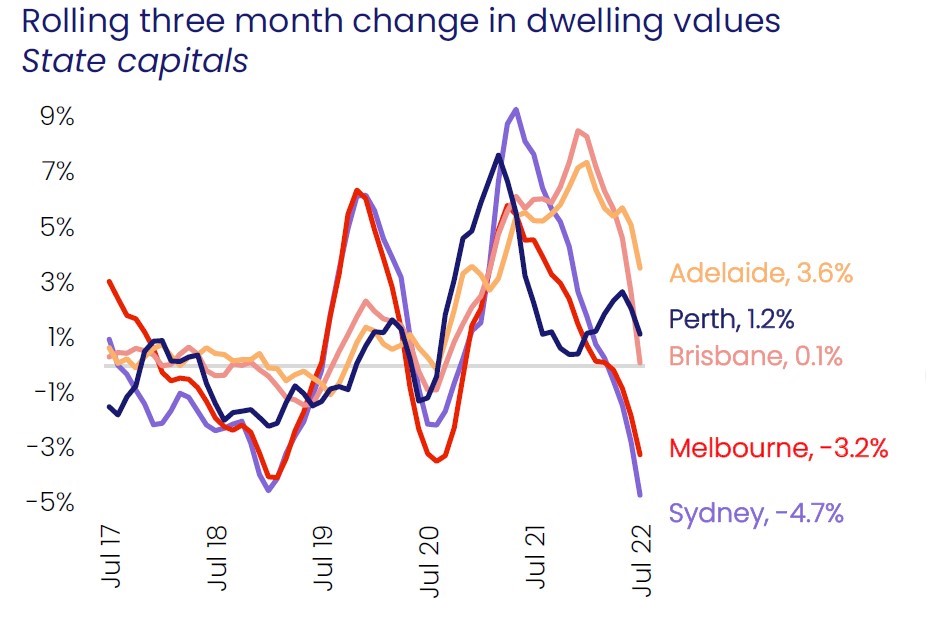

The combination of these factors is evident when looking at the changes to house prices over the last quarter. Sydney has seen prices change by -4.7% over that period, Melbourne -3.2%, Hobart -1.3% and Canberra -0.9%. These cities saw the greatest growth during the preceding years so this correction is really just seeing dwelling values returning to a more normal level.

Source: CoreLogic Hedonic Home Value Index, 1 August 2022.

On the market

In the 4 weeks to 24 July there were 36,615 new property listings advertised for sale which is 6.3% above the same time last year. Total active property listings are marginally lower than 12 months ago, sitting at 143,752 listings.

Tim Lawless, research director at CoreLogic stated that stock levels could increase before the end of the year as the trend in new listings ramps up at spring time where we may also see demand drop even further.

Rents

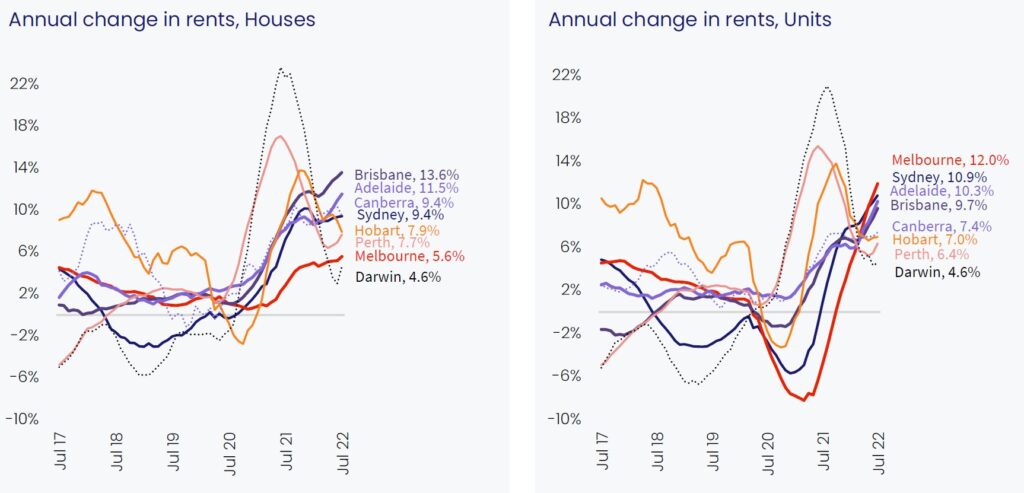

Rents maintained their growth trajectory through July with a 0.9% increase nationally, taking the quarterly growth to 2.8%, and yearly increase to 9.8%. This trend remains evident across all capitals and regional areas, led by Brisbane where rents grew by 4.2% over the three months to July.

“Rental markets are extremely tight, with vacancy rates around 1% or lower across many parts of Australia. The number of rental listings available nationally has dropped by a third compared to the five year average, with no signs of a lift in rental supply” Mr Lawless said.

Interestingly, there is no uniformity in the growth of rents across houses and units by state as depicted in the charts below. While Melbourne saw the greatest increase in unit rents, it performed second worst in house rents.

Source: CoreLogic Hedonic Home Value Index, 1 August 2022.

Outlook

With an expectation that the Reserve Bank has not finished raising the target cash rate, and most homeowners yet to have their loan repayments increased in line with the four recent rate hikes, it is expected that house values will continue to cool over the next few months, returning to where they should always have been.

Activity in early spring will be a good indicator of the state of the market as that is traditionally when buying and selling is heightened.

CLICK HERE TO DOWNLOAD THE FULL REPORT

Author: Frank Knez

Disclaimer: The opinions posted within this blog are those of the writer and do not necessarily reflect the views of Better Homes and Gardens® Real Estate, others employed by Better Homes and Gardens® Real Estate or the organisations with which the network is affiliated. The author takes full responsibility for his opinions and does not hold Better Homes and Gardens® Real Estate or any third party responsible for anything in the posted content. The author freely admits that his views may not be the same as those of his colleagues, or third parties associated with the Better Homes and Gardens® Real Estate network.