August at a glance

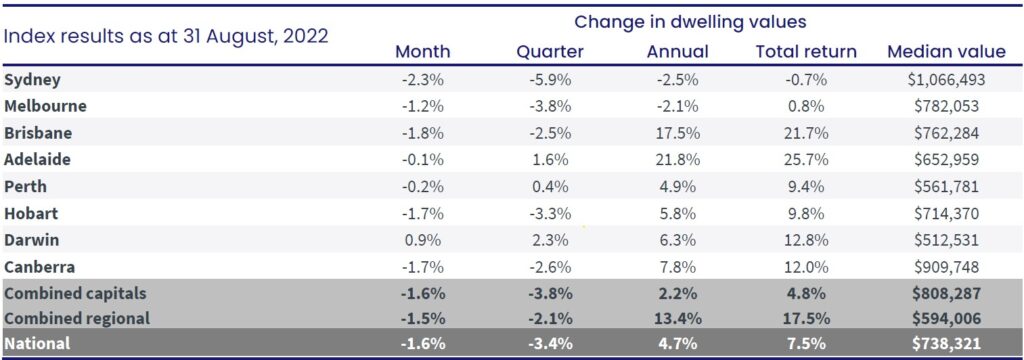

- Dwelling values reduced by 1.6% at a national level over the course of the month,

- The most significant drops were in Sydney (-2.3%), Brisbane (-1.8%), Hobart (-1.7%) and Canberra (-1.7%),

- Darwin was the only city to show growth in their housing values,

- There were less new properties advertised for sale with 23,097 new listings in the 4 weeks to 28 August,

- National rents increased by 0.8% over August to achieve an annual growth of 10.0%.

Dwelling values

The further reduction in house prices across most cities and regional areas sees national dwellings values 3.4% lower across the last quarter. All capitals with the exception of Darwin recorded a drop in values during the month of August, led by Sydney, Brisbane, Hobart and Canberra. Values in combined regionals were marginally lower compared to the capital cities over August but still outperformed its counterpart of the past quarter and year.

Source: CoreLogic Hedonic Home Value Index, 1 September 2022.

Source: CoreLogic Hedonic Home Value Index, 1 September 2022.

The trend over the previous four months has seen median house price reduce to a more normalised level, albeit most remain high on the back of record growth since COVID. Median values are currently $1,066,493 in Sydney, $782,053 in Melbourne, $762,284 in Brisbane, and $652,959 in Adelaide.

The driver for this continued decline in housing vales is the consecutive rises in the cash rate target by the Reserve Bank amounting to 2.25% since 4 May 2022 which has dampened buyer activity.

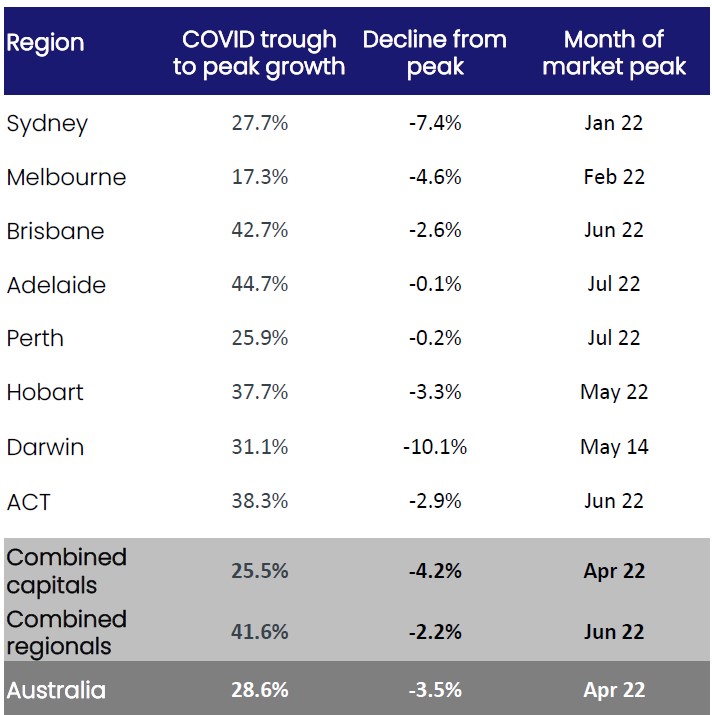

While there is much commentary about house values dropping and a supposed housing crash, it is important to note that it is normal for prices to operate in a cycle. Homeowners should also take comfort in the fact that despite seeing prices fall over the past few months, their capital gains still far outweigh this as depicted in the table below.

Source: CoreLogic Hedonic Home Value Index, 1 September 2022.

Values in Sydney have dropped by 7.4% from its peak in January 2022 however they increased by a whopping 27.7% since COVID which means property owners remain in a favourable position. The differential is more extreme in Brisbane and Adelaide where the recent reductions of -2.6% and -0.1% respectively come off the back of 42.7% and 44.7% increases.

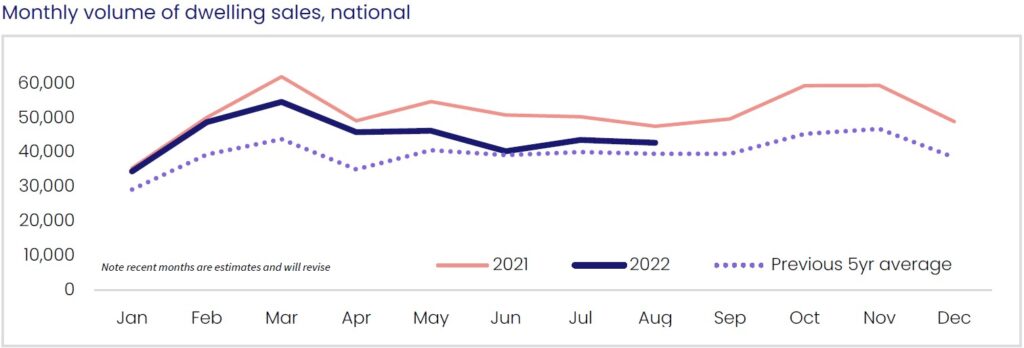

Property Sales

In the 4 weeks ending 28 August there were 23,097 new properties advertised for sale which is 13.4% above this time last year. Taking into account those that sold during the month, there are approximately 87,835 active property listings which is 11.3% above what it was 12 months ago.

“Despite the downwards trend in new listings through the colder months, the total number of capital city homes advertised for sale held reasonably firm, and there are currently 11.3% more homes available for sale compared to this time last year,” said Tim Lawless, Research Director at CoreLogic.

It is estimated that the volume of housing sold over the past three months was 14.8% lower that a year ago, underpinned by Sydney where sales were -35.4%, Canberra -18.9% and Melbourne -16.5%.

Source: CoreLogic Hedonic Home Value Index, 1 September 2022.

Rents

Rental prices rose by 0.8% in August nationally which is an easing after it peaked in May. This is a welcome relief from tenants who have seen annual growth in rents hit 10% which is the highest rate of growth over the past two decades.

Across the capital cities, house rents increased by more than double the rate of unit rents over the past five years, increasing 21.8% and 10.8% respectively.

“This trend is reversing as tenants become more willing to rent in higher density situations, especially in Sydney and Melbourne where unit rents are now rising at a much faster pace than house rents,” Mr Lawless said.

Outlook

There would be many homeowners with mortgages hoping that the Reserve Bank takes pause to gauge the impact of its consecutive rate rises, following another 0.50% increase in the cash rate target on 6 September, before increasing rates further when they next meet.

The increase in properties advertised for sales is more likely to be the result of buyer demand as opposed to a rise in new stock hitting the market. Spring traditionally brings a greater number of new listings and unless demand for housing ramps up somewhat, it is expected that total housing available for sale will increase over the remainder of 2022 which may further weigh down values.

CLICK HERE TO DOWNLOAD THE FULL REPORT

Author: Frank Knez

Disclaimer: The opinions posted within this blog are those of the writer and do not necessarily reflect the views of Better Homes and Gardens® Real Estate, others employed by Better Homes and Gardens® Real Estate or the organisations with which the network is affiliated. The author takes full responsibility for his opinions and does not hold Better Homes and Gardens® Real Estate or any third party responsible for anything in the posted content. The author freely admits that his views may not be the same as those of his colleagues, or third parties associated with the Better Homes and Gardens® Real Estate network.