November at a glance

- House prices increased by 1.3% in November which takes the national average 22.2% higher for the previous 12 months,

- Capital gains over November was the lowest monthly increase since January and highlights a softening market,

- There has been an increase in the number of properties listed for sale which is providing buyers with greater choice,

- Every capital city and regional area saw a rise in dwelling rents over November,

- The pace of house price appreciation has slowed and this trend is likely to continue into next year.

Housing values

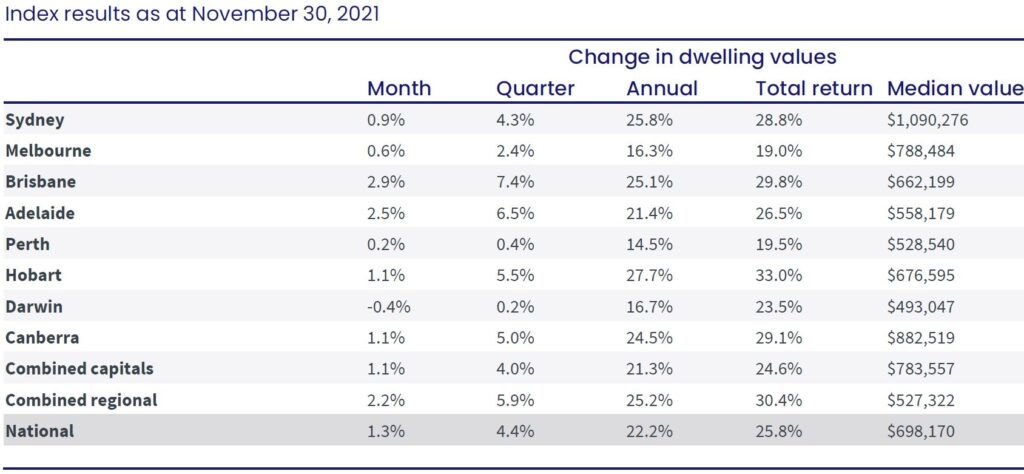

Dwelling values rose by 1.3% nationally over November which is slightly lower that previous months. Brisbane again had the strongest growth (+2.9%) followed by Adelaide (+2.5%), being the only two states to exceed 2%. The worst performers were Perth (0.2%) and Darwin where housing values declined (-0.4%).

Source: CoreLogic Hedonic Home Value Index, 1 December 2021.

The median house price has increased to $1,090,276 in Sydney, $788,484 in Melbourne, $642,1997 in Brisbane, and $558,179 in Adelaide.

Values in combined regionals outperformed capital cities during November, rising by 2.2% compared to 1.1%; as well as over the last 12 months where property prices grew by a stellar 25.2% while the combined capitals increased by 21.3%.

Source: CoreLogic Hedonic Home Value Index, 1 December 2021.

More homes available for sale

The number of new properties that were put on the market for sale increased significantly over November, and is a key factor in slowing down the rate of capital growth. Earlier in the year we saw new listings scooped up mere days after hitting the market, but now with more supply of properties, buyers do not have the same sense of urgency.

“Fresh listings are being added to the market faster than they can be absorbed, pushing total active listings higher. More listings imply more choice and less urgency for buyers,” noted CoreLogic’s research director, Tim Lawless.

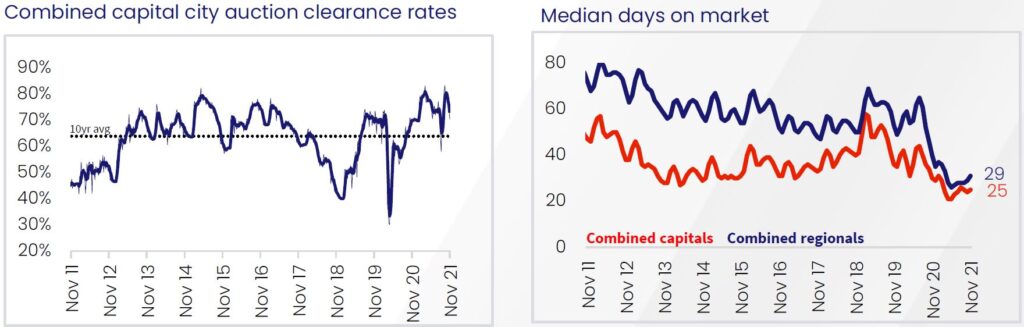

Auction clearance rates fluctuated during November but remained fairly high. The average number of day it takes for a property to sell is currently 25 in capital cities, and 29 in regional areas. This is expected to increase as more stock hits the market, slowly reducing the power that sellers had.

Source: CoreLogic Hedonic Home Value Index, 1 December 2021.

Rental market

Rental growth has been reasonably firm for the second half of the year, with the monthly change in rents at a national level resting between 0.6% and 0.7%. However, with house prices increasing at a higher rate, investors have seen a pinch in their yield which has fallen to a record low of 3.23%.

“Gross rental yields reached a new record low across every capital city and broad rest of state region in November

implying a growing imbalance between the costs associated with owning a home versus renting a home,” Mr Lawless said.

Outlook

The housing market continues to remain positive, and the trend we are seeing with lower rates of growth each month likely to remain into the new year. Buyers will still be incentivised by the low interest rate environment, but remain weary of this changing due to fixed mortgage rates already being increased by some lenders.

Buyer demand is expected to keep clearance rates relatively high, and see properties sell in a timely manner. When international borders and migration opens again, we will have additional means for the new supply of properties that hit the market to be consumed.

CLICK HERE TO DOWNLOAD THE FULL REPORT

Author: Frank Knez

Disclaimer: The opinions posted within this blog are those of the writer and do not necessarily reflect the views of Better Homes and Gardens® Real Estate, others employed by Better Homes and Gardens® Real Estate or the organisations with which the network is affiliated. The author takes full responsibility for his opinions and does not hold Better Homes and Gardens® Real Estate or any third party responsible for anything in the posted content. The author freely admits that his views may not be the same as those of his colleagues, or third parties associated with the Better Homes and Gardens® Real Estate network.