June at a glance

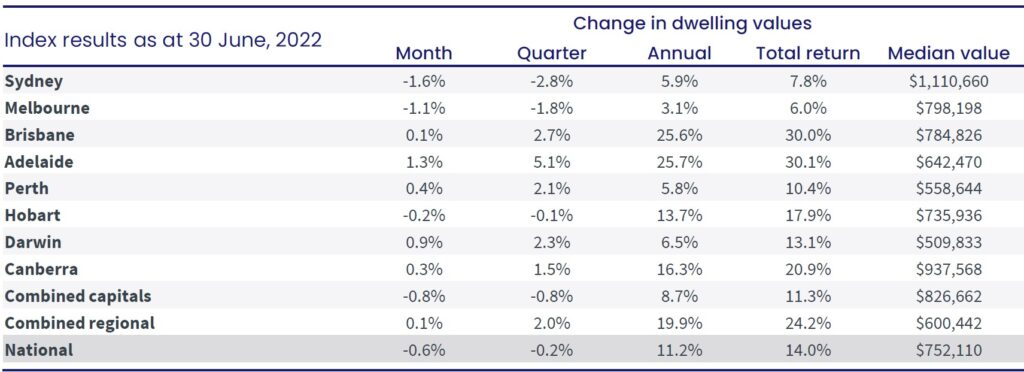

- Housing values reduced at a national level by 0.6% over the month of June,

- The largest drops were seen in Sydney (-1.6%) and Melbourne (-1.1%),

- Adelaide and Darwin recorded the highest growth with values rising by 1.3% and 0.9% respectively,

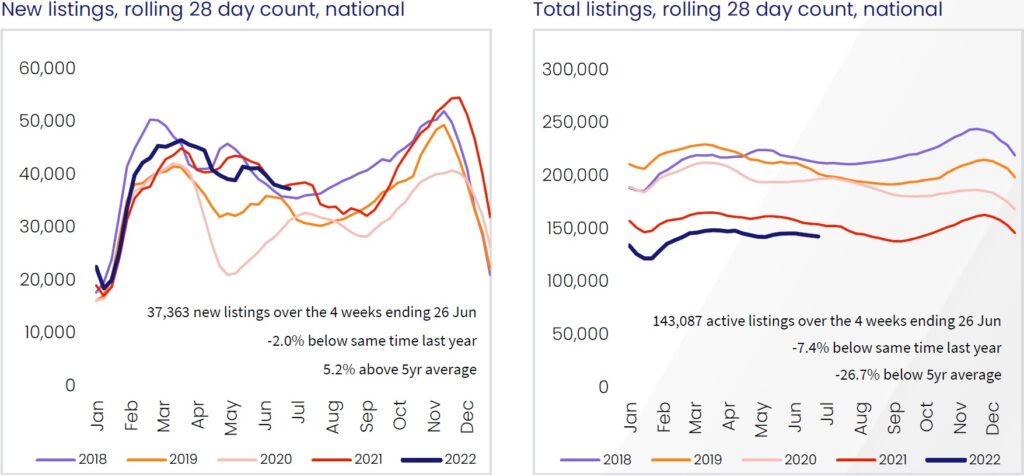

- 37,363 new properties were advertised for sale in the 4 weeks ending 26 June,

- National rents increased by 0.9% over the month, the highest growth since December 2007.

Dwelling values

June was the second consecutive month of national prices declining. The cash rate increase by the Reserve Bank in early June would have contributed to reducing buyer demand, and will likely do the same this month on the back of the latest 0.50% hike announced on 5 July. The reduction in values is viewed as the market returning to the level it should be at as opposed to the unsustainable highs we saw in recent times.

Source: CoreLogic Hedonic Home Value Index, 1 July 2022.

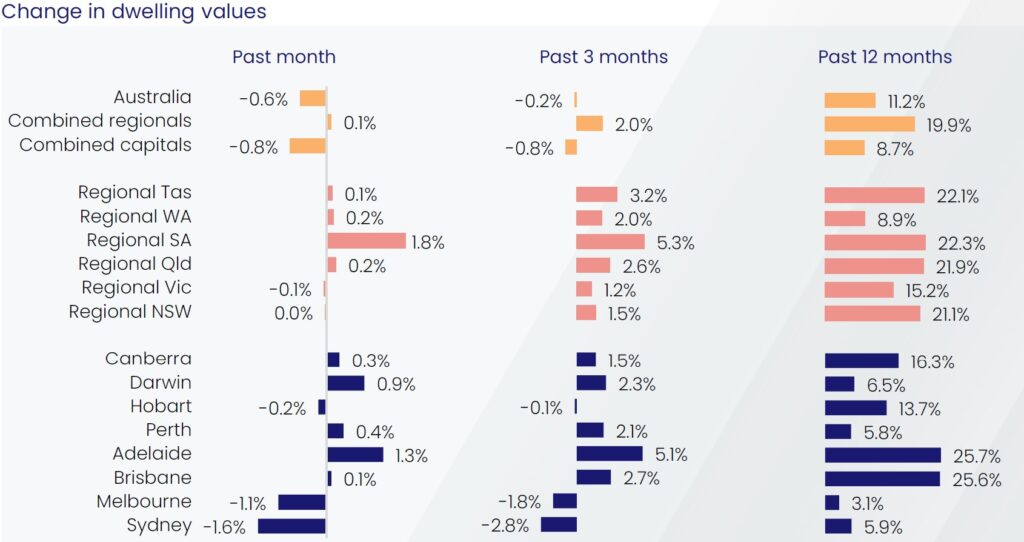

Source: CoreLogic Hedonic Home Value Index, 1 July 2022.

Sydney saw prices reduce the most (-1.6%) followed by Melbourne (-1.1%), and Hobart (-0.2%). The other cities recorded stable or increasing prices highlighting the different markets operating across the country. Dwelling values in Adelaide continue to grow with a 1.3% increase in June; while values in Darwin rose by 0.9%, Perth (+0.4%), Canberra (+0.3%) and Brisbane (+0.1%).

Regional areas recorded a slight increase over the past month and again outperformed the capital cities. Even within the regional cities we see performance vary by state as evident in the chart below. It is very clear that the housing market has cooled as we compare the change in values over the past month and quarter to what we were seeing 12 months ago.

Source: CoreLogic Hedonic Home Value Index, 1 July 2022.

On the market

There were 37,363 new property listings advertised for sale over the 4 weeks to 26 June, similar to the levels at the same time last year. Total active property listings have crept up over the course of the previous 6 months despite being 7.4% lower than the same time last year and 26.7% lower than the 5 year average.

Tim Lawless, research director at CoreLogic said that “the rise in advertised supply across some markets is mostly due to a slowdown in the rate of absorption”.

Source: CoreLogic Hedonic Home Value Index, 1 July 2022.

Rents

The cost of rental continues to rise across most of the capital cities, increasing by 0.9% in June and leading to an annual increase of 9.5%. Rents are now consistently rising at a faster pace than the value of housing meaning yields are improving for property investors.

The increase has been greater in units than in houses. Sydney and Melbourne, in particular, have seen unit rents increase significantly faster than house rents, likely as a result of people returning to medium and high density living after leaving for the suburbs in droves following the outbreak of the COVID pandemic.

Outlook

With home loan interest rates to increase as a result of the RBA lifting the cash rate target by another 0.50%, compounded by the rising level of inflation, it is expected that national dwelling values will continue to cool over the immediate term, returning to where they should always have been.

Consumer sentiment will be the hardest hit as home owners and buyers are having to manage higher cost of living expenses as well as increasing loan repayments on new and existing loans which will dampen home sales activity. Adding to this is the potential for official rates to increase further in coming months.

The buffer applied by lenders when approving loans in recent years coupled with a current low unemployment rate should help to minimise mortgage stress and the property market navigates the second half of 2022.

CLICK HERE TO DOWNLOAD THE FULL REPORT

Author: Frank Knez

Disclaimer: The opinions posted within this blog are those of the writer and do not necessarily reflect the views of Better Homes and Gardens® Real Estate, others employed by Better Homes and Gardens® Real Estate or the organisations with which the network is affiliated. The author takes full responsibility for his opinions and does not hold Better Homes and Gardens® Real Estate or any third party responsible for anything in the posted content. The author freely admits that his views may not be the same as those of his colleagues, or third parties associated with the Better Homes and Gardens® Real Estate network.